Services

Partner with ARYAA INVESTMENT for your Financial Transaction Execution

Regardless of where you are on your retirement journey, we can serve for smooth financial transaction.

Service Offerings

HIGH NETWORTH Individual Planning

There is a wide range of investments for HNWIs that includes tax planning,

alternative investments, fixed deposits, treasury bonds, government and corporate bonds,

etc.

Retirement Planning Strategies

Market indicators, such as, rate of inflation, decreasing Interest Rates,

no Pension post

retirement are a few factors that lead to a need for goal based customised investment plan

after factoring in your current income, expenses, savings, planned retirement age, etc.

Mutual Funds, NSC, Pradhan Mantri Vaya Vandana Yojana, Senior Citizen Saving Scheme,

Company Fixed Deposits are a few tools.

Tax Planning & Saving

Tax planning is a significant component of a financial plan. Reducing tax liability and

increasing the ability to make contributions towards retirement plans are critical for

success.

The deductions are available from Sections 80C through to 80U under Income Tax Act, 1961 and

can be utilised by eligible taxpayers.

Insurance Protection

Insurance Protection has proved to be crucial during the tough times of the Covid-19 pandemic

whether it be Life Insurance , Term Insurance , Health Insurance .

Education Savings

India does not have an instrument demarcated for higher education expenses of children, like

a college savings fund. What is required is an investment option that is structured

to accumulate savings and allows taxfree withdrawals for higher education.

The choice of instrument made, basis how to balance risk and return by investing in mutual

funds through SIPs would be a good option.

Fixed Income Planning

There are many investors who can't stand the volatility of market-linked plans.

They are in a constant hunt for investment options that could assure them of safe and steady

returns and at the

same time help them save their taxes.

Company fixed deposit, Bonds, Monthly Income Plans are few best income plans that come under

the low-risk category.

Financial planning

Financial planning is about how you can save money and invest it in the right places, rather than just collecting it. Financial goals may be short term such as planning a vacation or long term such as Retirement planning, something that everyone should have to live a happy life free of worry about the future. With so many responsibilities in life, we should consider investing our savings from time to time to be more secure.

Loans

Different loans for different needs.

Presenting a wide range of loans to power your dreams.

-

Upto 90% financing

-

Attractive interest rates

-

Quick processing

Products Offered

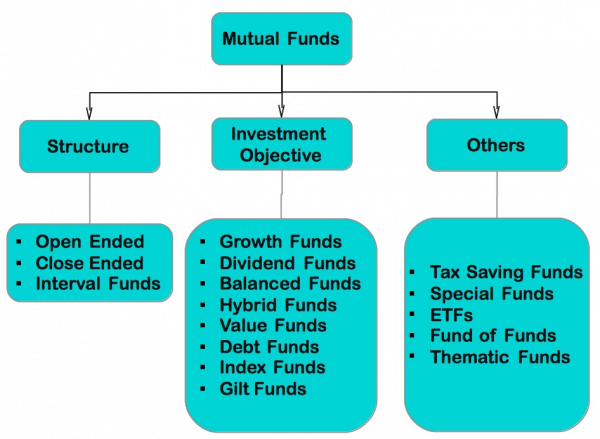

Mutual Fund

One of the most significant aspects of wealth building is return on investment.

Mutual funds allow you to gain exposure to a variety of asset classes and subclasses,

perhaps resulting in higher returns.

Life and Term Insurance

Life insurance is the best way to create wealth & secure family’s future in the event of

unfortunate death of the policyholder.

Benefits are Financial Security, Death Benefit, Maturity Benefit, Guaranteed Returns, Wealth

Creation, Tax Benefits,

Retirement planning, Loan facility.

Medical Insurance

Medical / Health insurance helps you pay for medical services and sometimes prescription drugs for your own self / Family and Dependants.

Vehicle Insurance

Coverage for Own Damage, Third Party Liability cover, Personal accident cover , Accidental Death -Compensation to Family and much more.

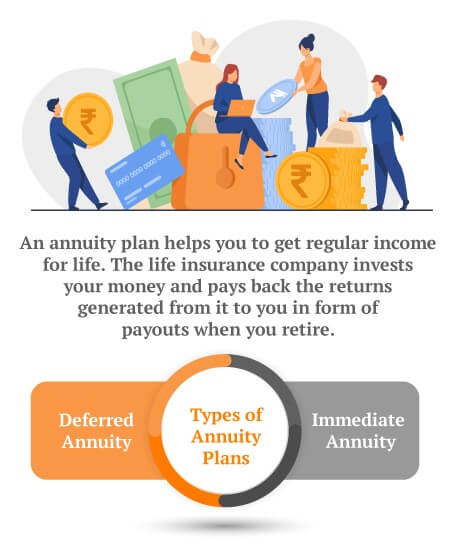

Annuities

An annuity is a financial instrument issued and backed by an insurance company that provides

guaranteed monthly

income payments for the life of the contract, regardless of market conditions.

Postal Schemes

As the name reflects these are schemes floated by Post Office which are considered very safe

but with low returns.

Some of the schemes are Senior Citizen Saving Scheme, National Saving Monthly Income,

National Saving Certificate, Kisan Vikas Patra etc.

Bonds and other Fixed-Income Investments

A bond is a fixed income investment in which an investor loans money to an entity (typically

corporate or governmental)

which borrows the funds for a defined period of time at a variable or fixed interest rate.

Loans

Home Loans

Turn your dream of owning a home into reality with our Home Loans. Whether you are buying an

apartment, constructing a house or renovating your home, we have the right Home Loan for

you.

Personal Loan

Quick and easy solution to all your urgent financial needs. Whether you need funds for a medical emergency in your family, your sibling’s wedding, or to renovate your home, a personal loan can finance all your requirements. Personal loans have many advantages over other forms of credit, such as credit cards and informal loans from friends, family members or untrustworthy financiers. Most salaried persons, self-employed and professionals can apply for personal loans. With attractive interest rates, minimal documentation and speedy processing, we offer among the best personal loans.

Gold Loans

Get high-value Gold Loans & quick disbursements

High ranking security

Educational Loan

Why should money stand in the way of the future? A simple way to fund your dreams is by obtaining an education loan. An education loan can assist you in gaining admission to the university of your interest. Our education loan is here to help you finance your dreams, education, and career ambitions.

Vehicle Loans

Don't just drive a vehicle, own it too!

Mortgage Loan

An innovative combination of a loan and overdraft facility with flexible repayment options against the security of your immovable property. Check out your loan against property eligibility and get exclusive add on benefits and tax benefits.

Benefits

-

Income from idle property.

-

Deposit surplus money, save interest

-

Flexibility to withdraw money

-

Competitive rate of interest

Loan Against Shares, Mutual Funds, Bonds and Debentures

Benefits:

-

Loan for personal needs

-

Get high value loans against securities.

-

No selling off securities

-

Easy repayment and transparent processing

-

UP to Rs. 1 Crore outstanding

-

Individuals having Demat account with any depository participant are eligible

-

Competitive rate of interest